They helped and successfully guided us to beat out 9 other competing offers! They were excellent at communicating with us at all times and they were extremely responsive. Having them on our team meant that we could always receive truthful, timely and accurate answers to our questions. We would most definitely utilize their services again and again for all of our real estate needs. Assets America was responsible for arranging financing for two of my multi million dollar commercial projects. At the time of financing, it was extremely difficult to obtain bank financing for commercial real estate.

Cash Ratio

Conveniently, you can view this video to step through the calculation. Using this information, creditors can decide whether to provide a company with a loan. Furthermore, it also dictates the terms lenders will imply on their loans.

Why is EBITDA Used in the Cash Coverage Ratio?

Analyzing interest coverage ratios over time will often give a clearer picture of a company’s position and trajectory. The « coverage » represents the number of times a company can successfully pay its obligations with its earnings. A lower ratio signals the company is burdened by debt expenses with less capital to spend. When a company’s interest coverage ratio is 1.5 or lower, it can only cover its obligations a maximum of one and one-half times. Its ability to meet interest expenses may be questionable in the long run.

Ask Any Financial Question

The total cash figure in the above formula is usually available in a company’s balance sheet. This figure includes all the cash and cash equivalent that a company has available. Although the interest expenses may include accrued interest, it is still crucial for companies to own resources to cover them.

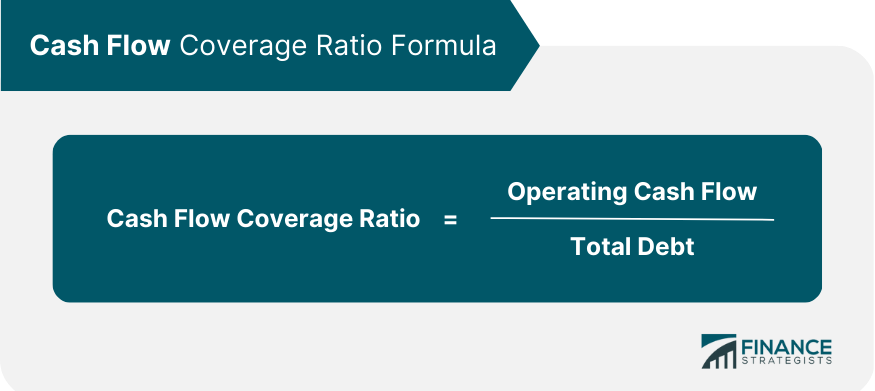

Note that we also label the cash flow to debt ratio as the cash flow coverage ratio. Clearly, you must average the current liabilities over that same period. what is a regressive tax In contrast to the CCR, the current CDCR points to the income statement. Conversely, this is different from the CCR, which depends only on the balance sheet.

- Cash equivalents are investments and other assets that can be converted into cash within 90 days.

- Now, you must find a new tenant to lease the space, and you’ll probably absorb vacancy costs.

- A good coverage ratio indicates that it’s likely the company will be able to make all its future interest payments and meet all its financial obligations.

- Conversely, when the cash coverage ratio number is less than 1 means the company’s total cash can not cover its interest expenses.

- Banks look closely at this ratio to determine repayment risk when issuing a loan to a business.

Create a Free Account and Ask Any Financial Question

These are short-term debt instruments that you can quickly convert to cash. They include Treasury bills, money market funds, commercial paper, short-term government bonds and marketable securities. They are all highly liquid and you can sell them for close to face value. Under generally accepted accounting principles (GAAP), you can convert cash equivalents to cash within 90 days. But it usually takes far less time — often minutes — to liquidate these assets. Typically, a TIE ratio above 3 indicates that the business has sufficient operating income to cover its long-term debt obligations multiple times.

You’ll also find that a company’s balance sheet generally reports its current or short-term liabilities separately from its long-term liabilities, making them easy to identify. In either case, the cash equivalents will include any short-term investments that can be converted into cash within three months or less. The credit analysts see the company is able to generate twice as much cash flow than what is needed to cover its existing obligations. Depending on its lending guidelines, this may or may not meet the bank’s loan requirements. Additionally, a more conservative approach is used to verify, so the credit analysts calculate again using EBIT, along with depreciation and amortization. The statement of cash flows showed EBIT of $64,000,000; depreciation of $4,000,000 and amortization of $8,000,000.

Firstly, the interest ratio is calculated by dividing EBIT by interest payment. Secondly, the debt service ratio is calculated by dividing operating income by total debt. Thirdly, the asset ratio is calculated by (tangible asset – short-term liabilities)/total debt, and cash coverage is calculated by (EBIT + noncash expense)/interest expense. Instead of using only cash and cash equivalents, the asset coverage ratio looks at the ability of a business to repay financial obligations using all assets instead of only cash or operating income. In finance, you often come across different terms that mean the same thing, or almost the same thing. Such is the case with the cash coverage ratio (CCR), which is the same as the cash ratio.

For some stakeholders, the asset coverage ratio may also be of value. Coverage ratios are used to measure the ability of your company to pay financial obligations. These obligations can include interest expense payments or all debt obligations, including the repayment of principal and interest. Similar to the cash coverage ratio, the interest coverage ratio measures the ability of a business to pay interest expense on any debt that is carried.