Sensitivity analysis involves altering one variable at a time to see how changes in that particular variable impact the project’s net present value (NPV). Scenario analysis, on the other hand, changes multiple variables simultaneously based on various potential scenarios, providing a more comprehensive risk profile. Capital budgeting decisions revolve around making the best choices to achieve maximum returns from investments.

Aligning Investments With Business Strategy

However, much like the payback period, it overlooks the total benefit of a project. As part of capital budgeting, a company might assess a prospective project’s lifetime cash inflows and outflows to determine whether the potential returns it would generate meet a sufficient target benchmark. In an M&A situation, potential investments often refer to target companies that a corporation intends to acquire or merge with. In this regard, capital budgeting assists in the formulation of tangible financial forecasts and outlooks.

Benefits

Companies that make wise investment decisions can enjoy superior technologies, more efficient processes, or better products, thus gaining a competitive edge. In other words, effective capital budgeting what forms a good business team can lead to a company enhancing its market position. On the contrary, poor capital budgeting decisions may result in significant losses, eventually affecting the company’s competitive position.

#2 Net Present Value Method (NPV)

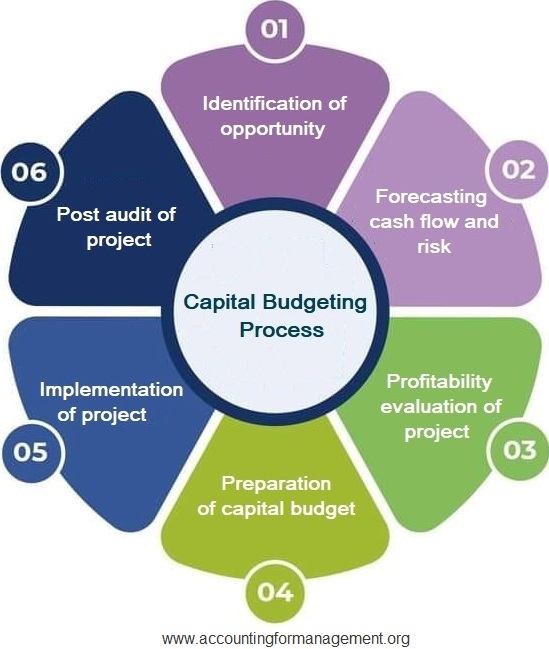

For payback methods, capital budgeting entails needing to be especially careful in forecasting cash flows. Any deviation in an estimate from one year to the next may substantially influence when a company may hit a payback metric, so this method requires slightly more care on timing. In addition, the payback method and discounted cash flow analysis method may be combined if a company wants to combine capital budget methods. Because a capital budget will often span many periods and potentially many years, companies often use discounted cash flow techniques to assess not only cash flow timing but also implications of the dollar. A central concept in economics facing inflation is that a dollar today is worth more than a dollar tomorrow, as a dollar today can be used to generate revenue or income tomorrow. Capital budgeting is a process that businesses use to evaluate potential major projects or investments.

- Discounted cash flow also incorporates the inflows and outflows of a project.

- A company should use the same capital budgeting technique in its post audit analysis as it used at the time of approval of the project.

- Throughput is measured as the amount of material passing through that system.

- These can include factors such as market risks, regulatory risks, technology risks, and financial risks.

Selecting a Project

Therefore, financial managers must not only rely on these tools but also consider external contingencies and scenarios. Deskera is a cloud system that brings automation and therefore ease in the business functioning. Deskera Books can be especially useful in improving cash flow and budgeting for your business. This involves the process of analyzing and assessing the actual results over the estimated outcomes.

Step 2 of 3

For some companies, they want to track when the company breaks even (or has paid for itself). For others, they’re more interested in the timing of when a capital endeavor earns a certain amount of profit. Capital budgeting is often prepared for long-term endeavors, then reassessed as the project or undertaking is underway. Companies will often periodically reforecast their capital budget as the project moves along. The importance of a capital budget is to proactively plan ahead for large cash outflows that, once they start, should not stop unless the company is willing to face major potential project delay costs or losses.

An IRR that is higher than the weighted average cost of capital suggests that the capital project is a profitable endeavor and vice versa. Another major advantage of using the payback period is that it is easy to calculate once the cash flow forecasts have been established. Throughput methods entail taking the revenue of a company and subtracting variable costs. This method results in analyzing how much profit is earned from each sale that can be attributable to fixed costs.

It is even harder to accurately predict how much revenue will gradually increase by thanks to the project. We’ve talked about many capital budgeting techniques and these powerful tools should be applied at this step to help decision-makers choose the right investment or project. Constraint analysis is used to select capital projects based on operation or market limitations.

It also reveals opportunity to invest more in successful projects and to cut losses on stranded ones. Development of the techniques used to evaluate capital investment opportunities has been largely the domain of financial economists. In the 1950s, the pioneering work of Dean (1951) and others marked the beginning of modern capital budgeting based on the use of discounted cash flow (DCF) approaches to capture the expected economic… To measure the longer-term monetary and fiscal profit margins of any option contract, companies can use the capital-budgeting process. Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. Under certain conditions, the internal rate of return (IRR) and payback period (PB) methods are sometimes used instead of net present value (NPV) which is the most preferred method.

In contrast, Budget Maestro by Centage aims to bridge the gap with an intuitive software interface that guides clients through the budgeting process. Also, the software delivers ‘what-if’ scenario capabilities — a must-have for those optimistic about their assumptions but want a safety net. However, its simplicity can prove to limit scalability for larger, more complex business setups. The future is uncertain and always carries the chance that outcomes won’t align with expected results. This discrepancy between the expected and actual outcomes is broadly referred to as risk.